[ad_1]

Advertising Disclosures

Economists are urging Americans to refinance to get gain of historically reduced refinance premiums. These very low costs have been fueled by the Fed’s endeavours to raise the economic climate and are not going to very last a great deal lengthier.

See Refi Gives Now

Savvy owners are getting edge and placing even though the iron is incredibly hot in get to maximize their extended-expression savings.

Lock in your rate now, ahead of the Fed satisfies

- Refinance rates are at historical lows: The Fed is artificially suppressing interest prices in order to hold them low. Note that these price-suppressing packages could conclude sooner than predicted. Jerome H. Powell, the central bank’s chair was lately quoted declaring “when the time comes to increase desire charges, we will certainly do that”.

- Rates will increase: It’s inevitable and it is only a matter of time prior to charges will start off to rise once again. They could even rise the future time the Fed meets. Bob Broeksmit, President of the House loan Bankers Affiliation all but ensured they would increase stating that “with mortgage loan fees perfectly under 3 p.c but envisioned to increase bit by bit this calendar year, many homeowners are performing now.”

- It can help save you a large amount: On ordinary, in January 2021, LendingTree buyers saved above $38K on the life time of their financial loan by refinancing.

- Property finance loan costs are tied to treasury bond costs: This suggests that treasury bond generate traits could raise home loan premiums. If bond yields raise, home loan fees would also enhance, suggests Matthew Speakman, economist at Zillow.

- There is no threat and it’s absolutely free to glance: By making use of LendingTree, you can review prices tailor-made to you and see how much you can help you save for free of charge. Our uncomplicated to use type only usually takes 2 minutes and there is no difficult credit rating pull.

See Refi Presents Now

When creditors compete you acquire. Get matched with up to 5 offers and compute your new payment. Additionally, a current study confirmed that browsing all-around can have a lot more of an result on a price than a buyer’s credit rating or down payment. Do not overlook out on this refinance option and ultimately check off home finance loan personal savings from your to-do checklist.

Here’s how to get started:

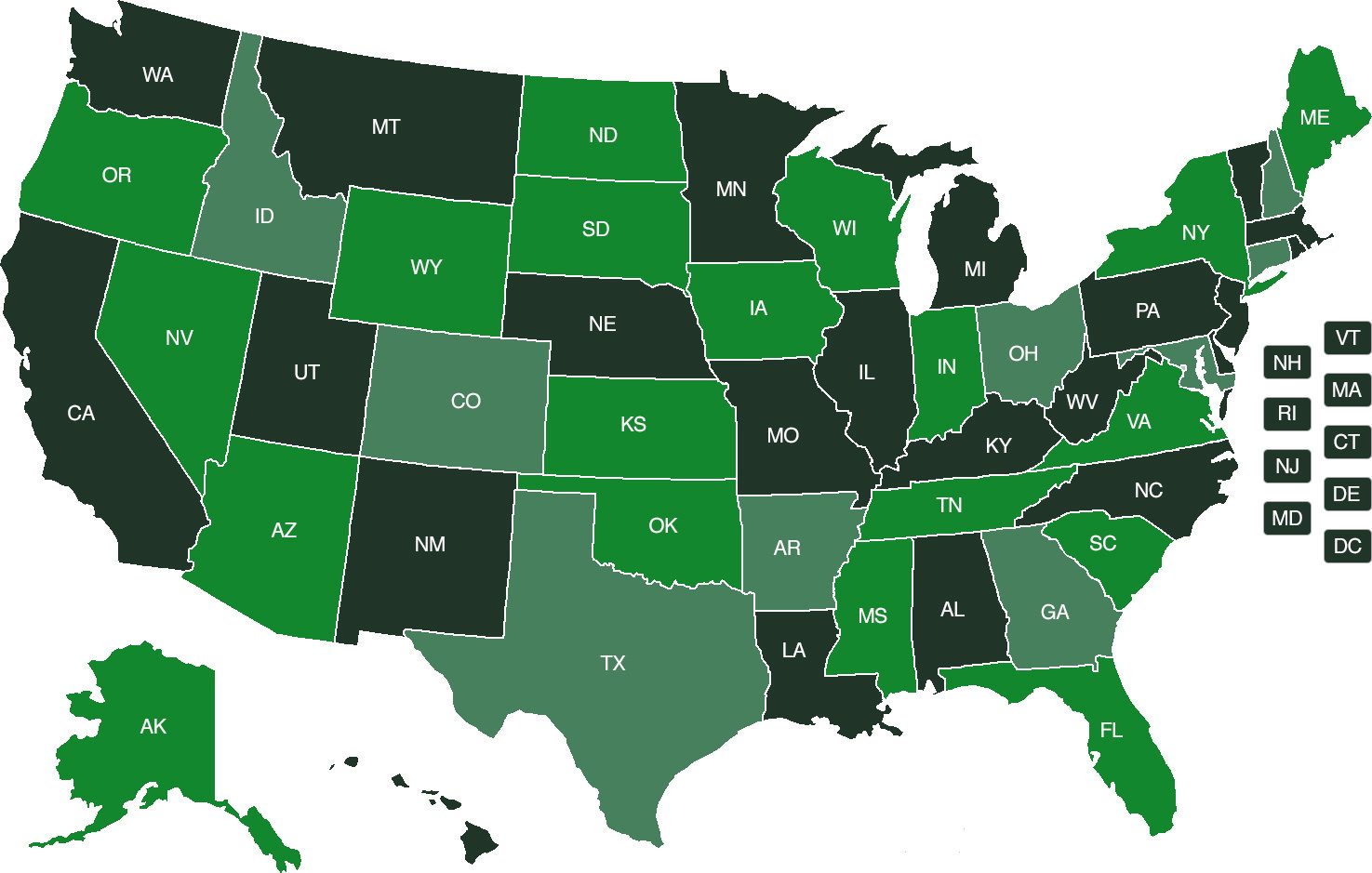

Action 1: Get commenced by clicking the map down below.

Stage 2: At the time you go by means of a handful of queries, you will have the opportunity to review the offers from several creditors!

See Refi Presents Now

[ad_2]

Supply backlink

More Stories

Oxford Languages

21 Notification On 24.10.2020

Homepage